Canada’s carbon tax is one of the most visible and fiercely debated policies in the country. The central idea is to put a direct price on carbon pollution to encourage people and businesses to reduce their emissions. But as the political debate rages, a crucial question often arises: if not a carbon tax, then what? What are the other tools governments can use to fight climate change?

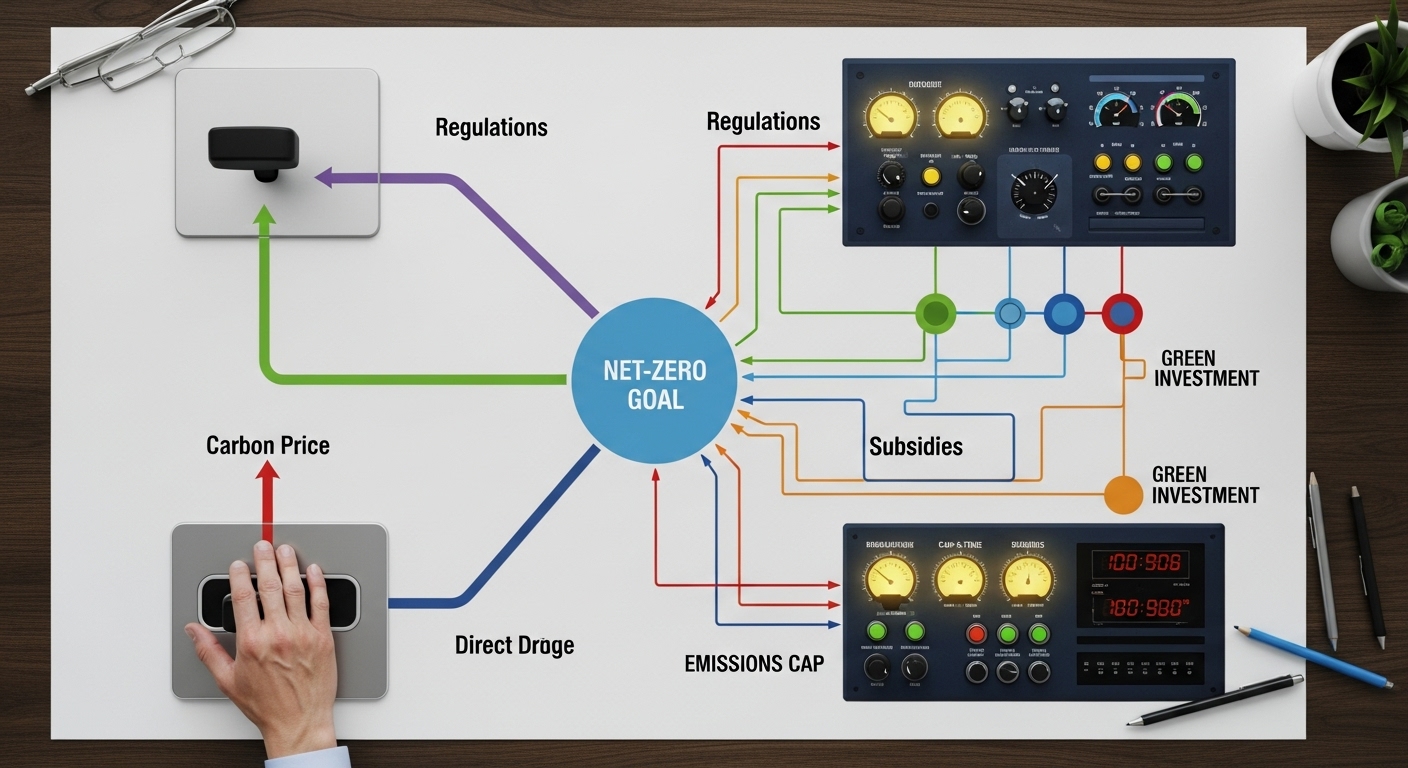

The reality is that there is no single magic bullet. Climate policy is a complex toolbox, and pricing pollution is just one of those tools. This explainer will provide a non-partisan look at the main alternatives, exploring how they work, their pros and cons, and how they are already being used as part of Canada’s broader climate plan.

The Baseline: Carbon Pricing

Before looking at the alternatives, it’s important to understand the two main forms of carbon pricing:

- A Carbon Tax, like Canada’s federal system, sets a fixed price per tonne of emissions. It’s predictable for businesses, but the amount of emissions reduction isn’t guaranteed. It’s a “price instrument.”

- A Cap-and-Trade System sets a firm, declining limit (a “cap”) on total emissions. It then lets companies trade pollution allowances, creating a variable market price. It guarantees a specific emissions outcome, but the price is less predictable. It’s a “quantity instrument.”

In our previous articles, we explained how the federal tax-and-rebate system works and examined its effectiveness. Now, let’s explore the other tools in the toolbox.

Alternative 1: The “Command and Control” Approach – Direct Regulations

Instead of making pollution more expensive and letting the market decide how to adapt, the government can set direct rules and standards that industries must follow. This “command and control” approach is a major part of Canada’s climate strategy.

Key Examples in Canada:

- Clean Electricity Regulations: These rules are designed to phase out electricity generated from unabated coal and natural gas, with the goal of making Canada’s grid net-zero by 2035. This forces utilities to invest in renewables, nuclear, or gas plants equipped with carbon capture.

- Clean Fuel Regulations: These regulations require producers and importers of gasoline and diesel to gradually reduce the carbon intensity (the amount of pollution per unit of energy) of the fuels they sell in Canada.

- Vehicle Emissions Standards: Canada has mandated that 100% of new passenger cars and trucks sold in the country must be zero-emission by 2035. This effectively phases out the sale of new internal combustion engine vehicles.

Pros and Cons:

Pro: Regulations provide certainty. They can guarantee a specific outcome in a targeted sector (e.g., no more gasoline cars sold after 2035).

Con: Economists generally view this as less efficient than pricing mechanisms. It can create “hidden” costs for consumers (e.g., more expensive cars or appliances) and requires complex, sector-by-sector government oversight.

Alternative 2: The “Quebec Model” – Cap-and-Trade

The most direct alternative to a carbon tax is a cap-and-trade system. Instead of setting the price, the government sets a firm limit—a “cap”—on the total amount of emissions allowed in a year. This cap is lowered over time.

How It Works:

Large polluters, like industrial facilities and fuel distributors, are required to hold “allowances” for every tonne of CO2 they emit. The government issues a limited number of these allowances, and companies can buy, sell, or trade them. This creates a “carbon market” where the price of an allowance is determined by supply and demand. Quebec has been operating a successful cap-and-trade system, linked with California’s, for over a decade.

Pros and Cons:

Pro: The primary advantage is environmental certainty. The “cap” guarantees that emissions will not exceed a certain level. It’s a very effective tool for hitting a specific emissions target.

Con: The price of allowances can be volatile, creating uncertainty for businesses. These systems are also generally more complex to design and administer than a straightforward carbon tax, as explained by the Canadian Climate Institute.

Alternative 3: The “Carrot” Approach – Green Subsidies and Investment

Instead of punishing polluters with a “stick” (like a tax or a cap), the government can use a “carrot” to encourage green choices with financial incentives.

Key Examples in Canada:

- Investment Tax Credits (ITCs): As detailed in the 2023 federal budget, Canada is offering billions of dollars in refundable tax credits to companies that invest in clean electricity, clean technology, and Carbon Capture, Utilization, and Storage (CCUS).

- Direct Funding & Financing: The government invests directly in green projects through entities like the Canada Infrastructure Bank and provides funding for clean fuel projects and other green initiatives.

Pros and Cons:

Pro: Subsidies can rapidly accelerate the development and adoption of new technologies and help build new, clean industries in Canada.

Con: This approach is very expensive for taxpayers. It also involves the government “picking winners,” which can lead to inefficiencies if the chosen technologies don’t pan out. The benefits often flow to large corporations rather than individual citizens.

Conclusion: The Real Answer is “All of the Above”

So, if not a carbon tax, then what? The real answer is that Canada’s climate plan is not, and has never been, just a carbon tax. The national strategy is a complex mix of all these policies working together. The carbon price works alongside direct regulations on electricity and vehicles, while the government simultaneously offers massive subsidies for clean technology.

The true political debate is not about choosing one single tool, but about deciding on the right *mix*. Should we rely more heavily on the predictable, economically efficient signal of a carbon price? Or should we lean more on direct regulations and government spending? Each path has different costs, benefits, and impacts on different parts of society. Understanding the whole toolbox is the first step to engaging in that crucial national conversation.