For years, the federal “carbon tax” has been the most debated, politicized, and misunderstood policy in Canada. It was designed as a two-part system: a charge on fuel to discourage pollution, and a rebate to protect families.

But in the spring of 2025, everything changed. On April 1, 2025, the government announced a major policy pivot, effectively ending the consumer fuel charge.

Here is a plain-language guide to how the system worked, why it changed, and the “hidden” industrial tax that is still very much alive.

Part 1: The “Carbon Tax” Was Actually Two Different Systems

To understand the policy, you have to understand that it wasn’t just one tax. It was a bifurcated system created by the Greenhouse Gas Pollution Pricing Act.

1. The Consumer Fuel Charge (The “Tax” You Saw)

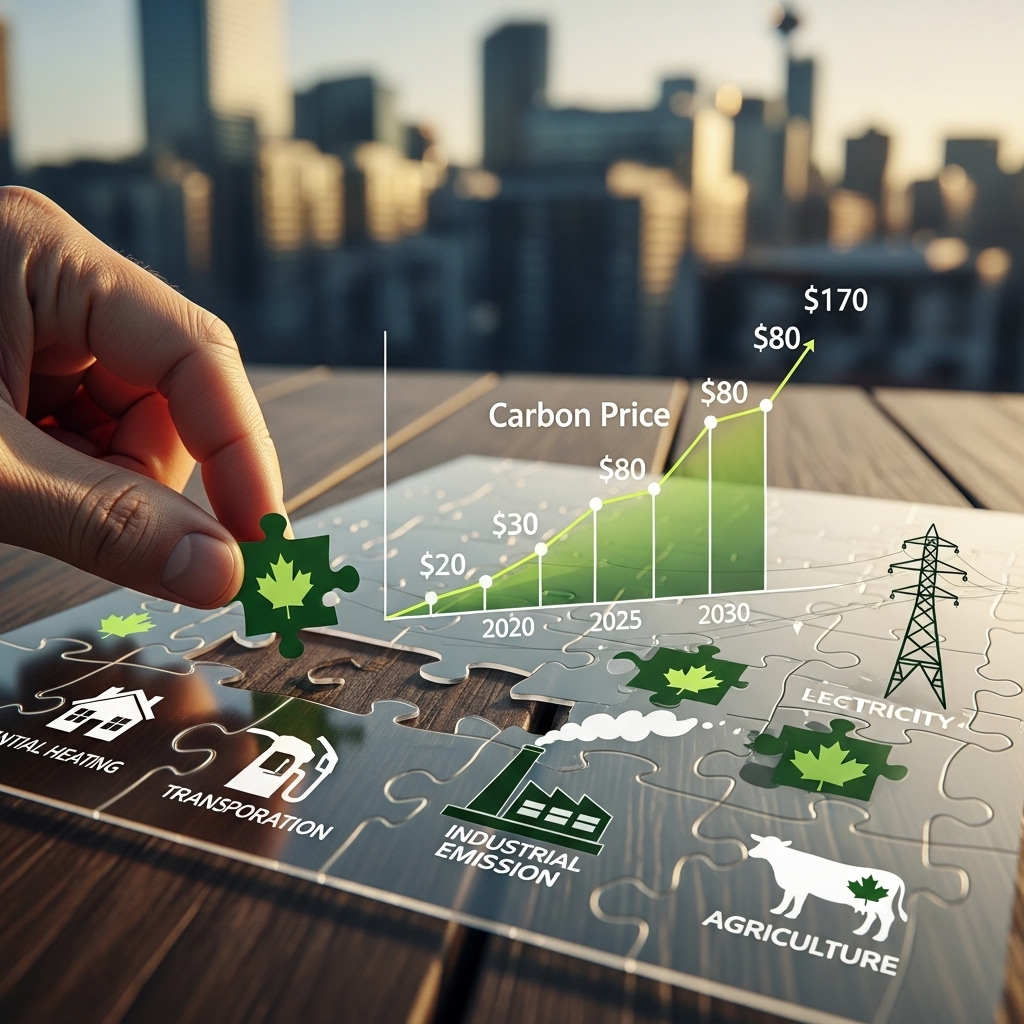

This was the visible tax added to gasoline, natural gas, and propane. It started at $20/tonne in 2019 and rose to $80/tonne by 2024. Its goal was simple: make polluting expensive so people would choose cleaner alternatives (like heat pumps or EVs).

2. The Output-Based Pricing System (OBPS) (The “Industrial” Tax)

This is the system for big industry (factories, power plants). Instead of paying tax on every tonne, they only pay if they pollute more than a specific efficiency standard. This protects Canadian jobs and prevents factories from moving to countries with no climate laws (“carbon leakage”). Crucially, this system is still in place.

Part 2: The Canada Carbon Rebate (How You Got Paid Back)

The most common myth was that the government kept the money. In reality, the law required the system to be “revenue neutral.”

- 90% to Families: The bulk of the money collected from the fuel charge was returned directly to households via the Canada Carbon Rebate (CCR), formerly the Climate Action Incentive.

- The “8 out of 10” Rule: The Parliamentary Budget Officer (PBO) consistently found that 80% of households got back *more* in rebates than they paid in direct costs. This is because wealthy people consume far more energy (bigger homes, more cars) and pay more tax, but everyone gets the same flat rebate.

- 10% to Institutions: The remaining 10% was earmarked for schools, hospitals, and small businesses (though the rollout of the SME rebate was plagued by delays).

Part 3: Myth-Busting the Carbon Tax

Before its repeal, misinformation about the tax was rampant. Here is what the economic data actually says.

MYTH: “The carbon tax caused the inflation crisis.”

FACT: False. According to the Bank of Canada, the carbon tax contributed only about 0.15% to inflation. The massive price hikes in groceries and housing were driven by global supply chains, war, and corporate pricing, not the carbon tax.

MYTH: “It was a government cash grab.”

FACT: False. The federal government retained zero net revenue. The money was legally mandated to be returned to the province it came from, mostly to households.

Part 4: The 2025 Pivot (What Happens Now?)

On April 1, 2025, the federal government set the consumer fuel charge rates to zero. This effectively ended the consumer carbon tax and the quarterly rebate cheques.

Why did they do it?

The policy faced intense political headwinds, especially after the heating oil exemption in 2023 created a perception of regional unfairness. The government has stated it is “refocusing” on industrial regulation.

The Industrial System Remains

While you no longer see the tax at the pump, big polluters are still paying. The Output-Based Pricing System (OBPS) remains the “workhorse” of Canada’s climate plan. Independent modeling shows this industrial system will drive between 23% and 39% of Canada’s emissions reductions by 2030—all without directly hitting your wallet.